Century Lithium Corp. (TSXV: LCE) (OTCQX: CYDVF) (Frankfurt: C1Z) (Century Lithium or the Company) is pleased to announce the results of a National Instrument 43-101 (NI 43-101) feasibility study (Feasibility Study, FS or Study) completed on its 100% owned Clayton Valley Lithium Project (Project) in Nevada, USA. The Feasibility Study was prepared by Wood Group USA, Inc. (Wood) and Global Resource Engineering, Ltd. (GRE). All currency amounts in this news release are presented in U.S. dollars.

"Century Lithium is proud to present our Feasibility Study. The Study indicates our Project has robust economics, made possible with our unique chlor-alkali and DLE processes" commented Bill Willoughby, President, and CEO. "Completion of the Study marks a major milestone for the Company and is the result of the dedicated work and efforts of our team of employees and consultants."

"Our process technology was developed by way of many trials and successes at our Pilot Plant in Amargosa Valley. As one of the few lithium-focused Pilot Plants in North America, we continue to operate safely and recently passed two years of testing. The data generated to date supports the Feasibility Study, and we continue to test various conditions and ideas to improve our process flow sheet," said Bill Willoughby.

With the Feasibility Study completed, the Company will now direct its focus on engineering and permitting. The Company is concurrently advancing discussions with government agencies, strategic partners, and other interested parties to provide funding to advance the Project and maximize the value to the Company's shareholders that is reflected in the FS.

FEASIBILITY STUDY SUMMARY

The information in the following tables highlight the Project's production and economic summaries.

|

Production Summary

|

|

Phase

|

Years

|

Mine tonnes per day (tpd)

|

Li2CO3 (tpa)

|

Capital Cost (B$)

|

|

1

|

1-5

|

7,500

|

13,000

|

$1.537

|

|

2

|

6-10

|

15,000

|

28,000

|

$0.651

|

|

3

|

11+

|

22,500

|

41,000

|

$1.336

|

|

Economic Summary

|

Units

|

Amount

|

|

Operating Costs (average)

|

$/t

|

8,223

|

|

Operating Costs (average w/NaOH credit)

|

$/t

|

2,766

|

|

After-tax NPV @ 8% Discount Rate

|

$ billion

|

3.01

|

|

After-tax IRR

|

%

|

17.1

|

RESOURCE AND RESERVES

The Mineral Resource and Reserve Estimates for the Project were updated for the Feasibility Study and built using geologic data and 1,318 lithium assays from 45 core holes drilled between 2017 and 2022. The constrained Measured and Indicated Resource Estimate is 1,207.33 Mt with an average grade of 957 ppm lithium and contains 1.155 Mt of Li or 6.148 Mt of LCE. The Proven and Probable Mineral Reserve Estimate was derived from the constrained Mineral Resources and contains 287.65 Mt with an average grade of 1,149 ppm lithium and contains 0.330 Mt of Li or 1.759 Mt of LCE and reflects an increase of 74.6 Mt and 0.48 Mt LCE compared to the 2021 Mineral Reserve Estimate. The Mineral Resources were generated with a pit shell that encompasses all mineralized material within the Property excluding all areas that will be used for Project infrastructure and placement of tailings, waste, and low-grade material.

|

Mineral Resource Estimate

|

|

Domain

|

Tonnes Above

Cut-off (millions)

|

Li Grade (ppm)

|

Li Contained

(million t)

|

LCE (million t)

|

|

Measured

|

858.38

|

990

|

0.849

|

4.524

|

|

Indicated

|

348.95

|

875

|

0.305

|

1.625

|

|

Measured & Indicated

|

1,207.33

|

957

|

1.155

|

6.148

|

|

Inferred

|

119.03

|

827

|

0.098

|

0.524

|

|

The effective date of the Mineral Resource Estimate is December 15, 2022. The QP for the estimate is Ms. Terre Lane, MMSA, an employee of GRE and independent of Century. The Mineral Resources are constrained by a pit shell with a 200 ppm Li cut-off and density of 1.505 g/cm3. The cut-off grade considers an operating cost of $16.90/t mill feed, process recovery of 83% and a long-term lithium carbonate price of $20,000/t. The Mineral Resource estimate was prepared in accordance with CIM Definition Standards (CIM, 2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (CIM, 2019). Mineral Resource figures were rounded. One tonne of lithium = 5.323 tonnes lithium carbonate. Mineral Resources are inclusive of Mineral Reserves.

|

|

Mineral Reserve Estimate

|

|

Domain

|

Tonnes Above Cut-

off (millions)

|

Li Grade (ppm)

|

Li Contained

(million t)

|

LCE (million t)

|

|

Proven

|

266.39

|

1,147

|

0.306

|

1.626

|

|

Probable

|

21.26

|

1,174

|

0.025

|

0.133

|

|

Proven & Probable

|

287.65

|

1,149

|

0.330

|

1.759

|

|

The effective date of the Mineral Reserve Estimate is December 15, 2022. The QP for the estimate is Ms. Terre Lane, MMSA, an employee of GRE and independent of Century. The Mineral Reserve estimate was prepared in accordance with CIM) Definition Standards (CIM, 2014) and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines (CIM, 2019). Mineral Reserves are reported within the final pit design at a mining cut-off of 900 ppm. The cut-off grade considers a mine operating cost of $1.98/t, a process operating cost of $14.27/t milled, a G&A cost of $0.65/t milled, process recovery of 83% and a long-term lithium carbonate price of $20,000/t. The cut-off of 900 ppm is an elevated cut-off selected for the mine production schedule as the elevated cutoff is 4.5 times higher than the break-even cut-off grade. Mineral Reserve figures have been rounded. One tonne of lithium = 5.323 tonnes lithium carbonate. Mineral Resources are inclusive of Mineral Reserves.

|

PROCESS METALLURGY & CHLOR-ALKALI PLANT

Metallurgical testing through 2020 focused on using sulfuric acid (H2SO4) to extract lithium from the clay. In late 2020, testing shifted to hydrochloric acid (HCl) for its improved compatibility with the deposit's chemistry. These benefits included higher lithium extractions, lower reagent consumptions, significantly better filtration of solids, and the ability to utilize certain DLE technologies in the recovery and concentration of lithium from the leach solutions.

A key component of the Project with chloride-based leaching is a chlor-alkali plant. The chlor-alkali plant provides the ability to produce the key reagents HCl and NaOH on-site from the electrolysis of a sodium chloride (NaCl) solution. A chlor-alkali plant represents a greater capital investment relative to that of a sulfuric acid plant but has important environmental and economic benefits for the sustainability of the Project. These benefits include replacing the purchase and transportation of sulfur with regionally sourced salt, and a reduction in emissions and the physical footprint of the operation with dryer, non-sulfate tailings.

Additionally, the chlor-alkali plant will generate significant quantities of NaOH surplus to the Project's operational needs and therefore available for sale. The chlor-alkali plant will utilize modern electrochemical cell technology thereby producing membrane grade sodium hydroxide without the energy consumption and environmental problems of older technologies. The surplus amounts of NaOH are inherent to the operation of the plant and the sales represent a significant offset to the Project's operating costs.

PILOT PLANT

In 2021, Century Lithium constructed a Pilot Plant in Nevada to leach one tonne per day of lithium clay and produce a high-grade lithium chloride solution which is processed off-site at Saltworks Technologies, Inc. (Saltworks), at their Richmond, British Columbia processing plant to make battery-quality Li2CO3. To maximize lithium recovery, the Company purchased the license rights and pilot-stage equipment to DLE an ion-exchange-based process and incorporated it into the Pilot Plant. The DLE license is held in perpetuity and royalty free by the Project.

Throughout its Pilot Plant program, the Company has sought improvement in its process methods. The Company obtained a provisional patent in 2023 with the U.S. Patent and Trademark Office, U.S. Department of Commerce. The provisional patent is titled System and Method for Extracting Lithium from Clay and Other Materials in a Chloride Solution Using Individualized Pretreatments. The patent pending process encompasses the Company's flowsheet and protects its methods of leaching lithium-bearing solids and handling solutions, precipitates, and residues.

LITHIUM EXTRACTION, RECOVERY & Li2CO3 PRODUCTION

A lithium recovery of 78% is used in the Feasibility Study, based on the data collected in over two years of operations at the Pilot Pant.

- Feed material grades averaged 1,100 ppm

- Leach solution samples varied from 200 to 320 ppm Li

- Lithium extractions averaged 88% and varied from 80 to 95%

- DLE lithium recoveries were typically above 90%

- 10% of the lithium in solution is retained in the moisture remaining in the tailings

Extraction rates do not account for losses downstream and are only indicative of the potential overall recovery. Work at the Pilot Plant continues to focus on reducing losses of lithium to tailings. A small loss of lithium from processing the DLE product solutions into Li2CO3, and the recycling of process solutions to the DLE and leach areas is anticipated.

During 2022 and 2023, Saltworks processed the DLE product solutions from the Pilot Plant and made battery-quality Li2CO3 at greater than 99.5% purity. Modifications at the Pilot Plant in mid-2023 increased lithium solution grades to over 14 grams per liter which simplified the flowsheet and eliminated the evaporation stage for production of Li2CO3.

PRODUCTION PLAN

The Project's production plan comprises three equal phases of production rate increases, Phase 1 and Phase 2 production rates are maintained over five years each and Phase 3 is maintained for 30 years. This approach was selected to reduce capital exposure and risk by dividing the Project's production schedule into realistic phases of construction and equipment installation. The plan fully utilizes the Project's Mineral Reserve.

Phase 1 includes all work required to implement the Initial Project Plan including all necessary mining and processing infrastructure. The Phase 2 cost estimate focuses on an expansion within the footprint of Phase 1. Phase 3 development includes an additional processing plant and facilities not built in the previous phases and allows for a fourth phase of expansion.

LITHIUM CARBONATE AND SODIUM HYDROXIDE SALES PRICES

A price of $24,000/t of Li2CO3 is used in the Feasibility Study as the Project base case. This price is selected as a conservative mid-point between current market prices which are under $20,000/t Li2CO3 and forecast prices obtained from Benchmark Mineral Intelligence which are in the range of $23,000 to $39,000/t Li2CO3 during Phase 1 and $29,000 to $31,000/t Li2CO3 thereafter (Benchmark Mineral Intelligence, Lithium Forecast Q1 2024). The sales price is free on board (FOB) the Project site for battery quality Li2CO3.

NaOH is a product of the chlor-alkali process and a sales price of $600/dmt FOB the Project is used in the Feasibility Study as the Project base case. Based on the material mass balance, it is expected that surplus NaOH will be available for sale at rates of 120,000 to 360,000 dmt per annum, depending on Project Phase. This price is based on a February 2023 market study by Global Exchange and Trading, Inc. where it was determined the Project's surplus NaOH can be readily sold in the western U.S. which currently relies heavily on imports arriving at west coast ports.

CAPITAL COST ESTIMATE

The basis for the capital cost estimate follows AACE Class 3 for feasibility studies. Contributors to the estimates are GRE (mining), Wood (process plant and infrastructure), ThyssenKrupp Nucera (chlor-alkali plant) and Century Lithium (property information and owners' costs). The capital cost estimates by phase are summarized as follows.

|

Installed Capital Costs

|

Initial

Phase 1 ($M)

|

Expansion

Phase 2 ($M)

|

Expansion

Phase 3 ($M)

|

|

Mining & Site Preparation

|

$64

|

$7

|

$27

|

|

Process Facilities

|

$517

|

$205

|

$477

|

|

Chlor-Alkali Plant

|

$496

|

$336

|

$496

|

|

Buildings, Services & Infrastructure

|

$130

|

$5

|

$42

|

|

Indirect & Owners Costs

|

$234

|

$72

|

$190

|

|

Contingency

|

$96

|

$27

|

$105

|

|

Total Capital Cost

|

$1,537

|

$651

|

$1,336

|

|

Notes: Totals may not sum due to rounding, Contingency and site Indirects for chlor-alkali plant is included in the Chlor-Alkali Plant line item, contingency for mining is included in the Contingency line item, indirect costs for mining are not included in the Indirects and Owner's Costs line item

|

The Phase 2 capital costs represent the expansion of the process facilities and infrastructure established in Phase 1. The Phase 3 capital costs support an additional processing plant and facilities not built in the previous phases. In the Project schedule, a 2-year period is allocated for the time to construct and commission each phase.

Sustaining capital over the life of the Project is estimated at $315 million for tailings facility expansion and equipment replacements. These costs are in addition to the expansion capital costs shown above.

OPERATING COST ESTIMATES

The following information highlights the operating cost estimates for each phase in dollars per tonne of Li2CO3, before and after deducting sales of surplus NaOH.

|

Initial Phase 1

(7,500 tpd mill feed)

|

$ (000s)/y

|

$/t mill feed

|

$/t LCE

|

|

Mining

|

$13,754

|

$5.43

|

$1,205

|

|

Processing and G&A

|

$57,515

|

$21.01

|

$4,428

|

|

Chlor-Alkali Plant

|

$61,787

|

$22.57

|

$4,757

|

|

Total Operating Cost

|

$133,056

|

$49.01

|

$10,390

|

|

Less NaOH Sales (FOB mine)

|

$78,272

|

$28.95

|

$6,026

|

|

Net Operating Cost

|

$54,784

|

$20.06

|

$4,364

|

|

Note: Totals may not sum due to rounding

|

|

Expansion Phase 2

(15,000 tpd mill feed)

|

$ (000s)/y

|

$/t mill feed

|

$/t LCE

|

|

Mining

|

$24,901

|

$4.26

|

$766

|

|

Processing and G&A

|

$82,018

|

$14.98

|

$3,157

|

|

Chlor-Alkali Plant

|

$105,138

|

$19.20

|

$4,047

|

|

Total Operating Cost

|

$212,057

|

$38.44

|

$7,970

|

|

Less NaOH Sales (FOB mine)

|

$142,350

|

$26.00

|

$5,479

|

|

Net Operating Cost

|

$69,707

|

$12.44

|

$2,491

|

|

Note: Totals may not sum due to rounding

|

|

Expansion Phase 3

(22,500 tpd mill feed)

|

$ (000s)/y

|

$/t mill feed

|

$/t LCE

|

|

Mining

|

$22,064

|

$2.70

|

$561

|

|

Processing and G&A

|

$119,945

|

$14.60

|

$3,078

|

|

Chlor-Alkali Plant

|

$151,325

|

$18.43

|

$3,884

|

|

Total Operating Cost

|

$293,334

|

$35.73

|

$7,523

|

|

Less NaOH Sales (FOB mine)

|

$213,525

|

$25.99

|

$5,479

|

|

Net Operating Cost

|

$79,809

|

$9.74

|

$2,044

|

|

Note: Totals may not sum due to rounding

|

ECONOMIC MODEL AND SENSITIVITY

The cash flow model is developed using base prices of $24,000/t for Li2CO3 and $600/dmt for NaOH.

|

Average Annual Values

|

Units

|

Initial

Phase 1

|

Expansion

Phase 2

|

Expansion

Phase 3

|

|

Li2CO3 Sales

|

t

|

11,885

|

26,753

|

39,098

|

|

NaOH Sales

|

dmt

|

130,488

|

237,250

|

355,875

|

|

Gross Sales

|

$ million

|

$282.4

|

$635.7

|

$929.0

|

|

Before-tax Cash Flow

|

$ million

|

$231.3

|

$553.3

|

$825.3

|

Lithium carbonate sales are the average over each Phase including ramp up to the stated production rate. Gross sales are revenues from Li2CO3 and NaOH sales are before operating costs and after royalty. Before-tax Cash Flow is gross sales minus operating costs. Taxes are applied at federal, state and county rates after allowances for amortization, depletion, and depreciation only. Possible tax credits under the U.S. Inflation Reduction Act or other programs are not included.

The Project base case generates a 17.1% after-tax IRR and NPV-8% of $3.01 billion. These results are sensitive to changes in operating assumptions including the sales price of Li2CO3.

- At 75% of the base case, or $18,000/t LCE, the after-tax NPV@ 8% is $1.52 billion, and the after-tax IRR is 12.9%.

- At 125% of the base case, or $30,000/t LCE, the after-tax NPV@ 8% is $4.47 billion, and the after-tax IRR is 20.9%.

- For every $1,000/t change in the price of lithium carbonate, the after-tax NPV@8% changes by about $250 million.

|

Project Sensitivity

|

Units

|

75 %

|

Base Case

|

125 %

|

|

Lithium Price

|

$/t LCE

|

$18,000

|

$24,000

|

$30,000

|

|

NPV-8%

|

$ billion

|

$1.52

|

$3.01

|

$4.47

|

|

IRR

|

%

|

12.9

|

17.1

|

20.9

|

PROJECT ADVANCEMENT

The Company has completed multiple environmental studies in advance of permitting and is examining ways to optimize power requirements and incorporate alternative energy solutions.

The recommendations of the FS include continuing the permitting process, engaging with governmental agencies and other parties, and proceeding with detailed engineering to further advance the Project.

Among these steps, the Company has contacted the U.S. Department of Energy's (DOE) Loan Programs Office (LPO) and plans to initiate the pre-application process under the Title Seven Clean Energy Financing program when the Feasibility Study report is complete.

Century Lithium | centurylithium.com

.jpg?r=3079)

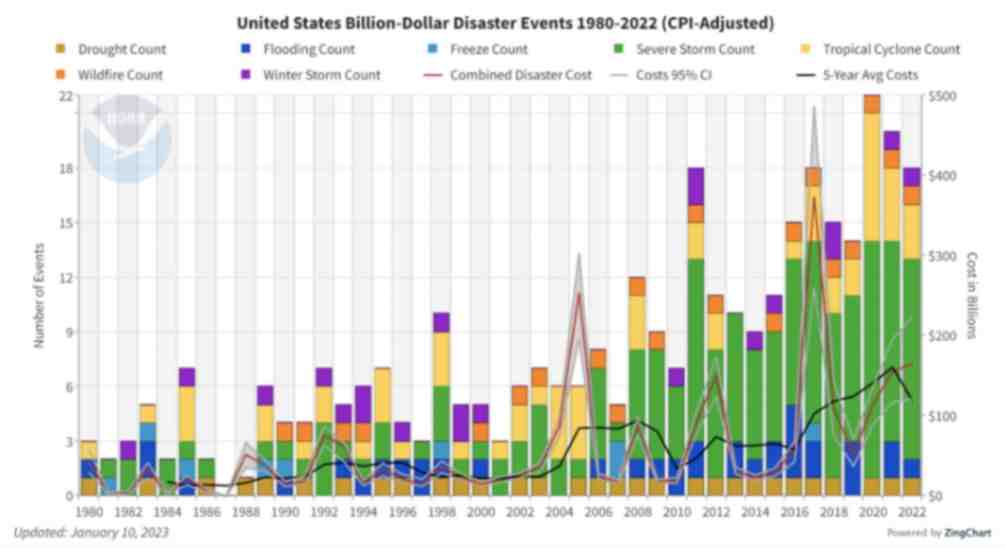

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.